COLGATE PALMOLIVE (CL)·Q4 2025 Earnings Summary

Colgate-Palmolive Q4 2025: Growth Accelerates, Stock Jumps 2% on Record Cash Flow

January 30, 2026 · by Fintool AI Agent

Colgate-Palmolive (CL) delivered an acceleration in growth for Q4 2025, with net sales rising 5.8% and organic sales up 2.2% despite continued challenging market conditions and a 0.9% headwind from exiting the private label pet food business . The company also achieved record free cash flow of $3.6B for 2025 and announced its 63rd consecutive year of dividend increases . Shares rose 2.1% in aftermarket trading to $86.81, the strongest post-earnings reaction since Q2 2024.

Did Colgate Beat Earnings in Q4 2025?

Colgate delivered meaningful acceleration across all key metrics in Q4 versus a challenging Q3 :

*Values retrieved from S&P Global

The organic sales growth of 2.2% included a 0.9% negative impact from the strategic exit of private label pet food manufacturing, implying underlying organic growth of approximately 3.1% . This represented a notable improvement from Q3's 1% organic growth, which management attributed to August softness and trade destocking .

Both oral care and pet nutrition (excluding private label) led growth during the quarter, with net sales and organic sales growing in every category .

What Did Management Guide for 2026?

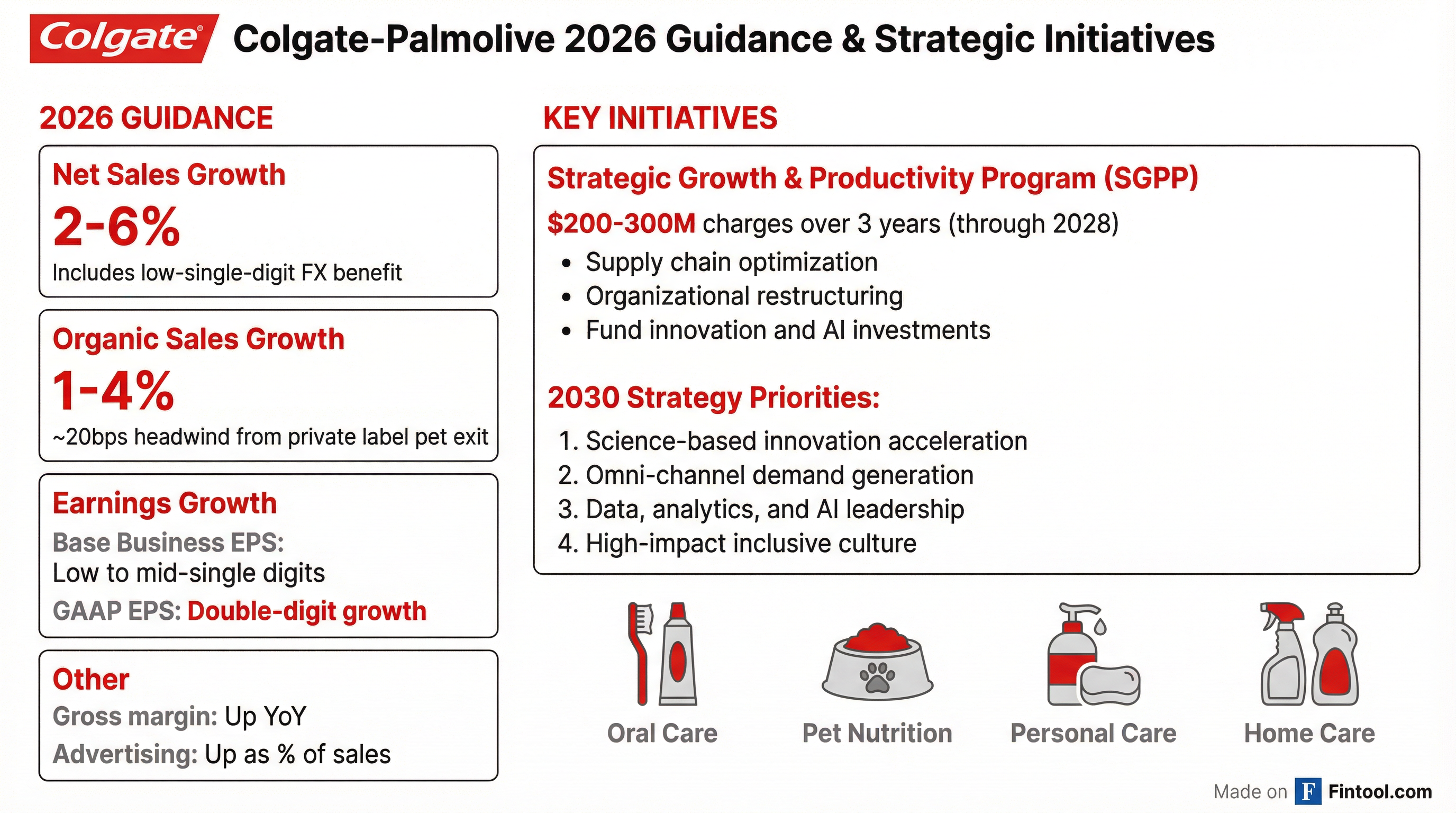

Management provided 2026 guidance based on current spot rates and tariffs announced/finalized as of January 28, 2026 :

The organic sales guidance of 1-4% compares to the company's long-term target range of 3-5% , reflecting continued category softness that management acknowledged in Q3 when CEO Noel Wallace noted global category growth had slowed to approximately 2% versus 4-5% exit rates in 2024 .

Consensus estimates heading into 2026 call for:

- Revenue: $21.0B (implying ~3.6% growth)*

- EPS: $3.84 (implying ~5.2% growth)*

*Values retrieved from S&P Global

How Did the Stock React?

CL shares rose 2.1% in aftermarket trading to $86.81, up from the $85.00 prior close. This marked the strongest post-earnings reaction since Q2 2024 (+3.0%) and reverses a string of muted or negative reactions over the past several quarters.

The positive reaction likely reflects:

- Growth acceleration — Q4 results showed meaningful improvement versus Q3's challenging performance

- Record free cash flow — $3.6B demonstrated strong cash generation despite top-line headwinds

- Constructive guidance — 2026 outlook suggests stabilization with upside potential if categories recover

At $86.81, shares trade below the 52-week high of $100.18 and analyst consensus target price of ~$89*.

*Values retrieved from S&P Global

What Changed From Last Quarter?

Several key dynamics shifted between Q3 and Q4:

Improvements:

- Organic sales accelerated from 1.0% to 2.2%

- Underlying organic growth (ex-private label) exceeded 3%

- All four categories delivered organic sales growth in Q4

- Sequential improvement in organic sales vs. Q3 in every division except North America

- Emerging markets grew ~4.5% organic with a good balance of price and volume

- India returned to growth, better than expected

- Mexico and Brazil up high single digits

- Hill's underlying volume (ex-private label) up 2%

Ongoing Challenges:

- Categories remain soft globally, growing ~1.5-2.5% vs. historical 4-5% levels

- North America categories particularly weak — 9-10 categories with negative volume in Oct-Nov

- Consumer uncertainty persists across markets

- Canada impacted by "Buy Canadian" sentiment affecting Hill's

- Tariff environment remains dynamic, though impact factored into guidance

- Raw material inflation from fats, oils, and tallow continues

- Some competitors increasing couponing activity

Full Year 2025 Highlights

For full year 2025, Colgate delivered :

*Values retrieved from S&P Global

The organic sales growth of 1.4% included a 0.7% negative impact from lower private label pet volume as the company exited that non-strategic business . CFO Stan Sutula noted that the strong cash generation came from both "generating cash profits" and "really good performance on net working capital" .

Historical Free Cash Flow Trend ($ billions) :

Strategic Growth and Productivity Program (SGPP)

The company continues executing on its three-year SGPP announced in August 2025, which is projected to result in cumulative pre-tax charges of $200-$300 million through 2028 .

Key SGPP initiatives include:

- Supply chain optimization — Driving agility and efficiencies

- Organizational restructuring — Aligning structure to support strategic initiatives

- Innovation acceleration — New resources focused on science-based innovation

- AI and analytics investment — Agentic AI, data analytics, and omni-channel demand generation

As CFO Stan Sutula noted on the Q3 call: "This is designed from a position of strength to enable us to fund incremental investments, as well as delivering savings to continue to deliver dollar-based earnings growth" .

Market Share Performance

Colgate highlighted continued market share gains in oral care :

- Global toothpaste market share: Up 10 basis points YTD (volume basis)

- Global manual toothbrush market share: Up 60 basis points YTD (volume basis)

In Europe, the elmex brand continues driving record share gains, with toothpaste share reaching 13.2% YTD versus 12.4% in 2024 .

Capital Allocation & Shareholder Returns

Colgate maintained its commitment to returning cash to shareholders :

- Dividend: Increased for 63rd consecutive year; 131 consecutive years of dividend payments

- Dividends per share: $2.06 in 2025 vs. $1.98 in 2024

- Cash returned: $2.9B in 2025 through dividends and share repurchases

- 10-year total: $28.5B returned to shareholders

Key Risks and Watchpoints for 2026

Based on management commentary and guidance assumptions, investors should monitor:

-

Category recovery timing — Management acknowledged categories remain soft at ~2% growth vs. 4-5% historical levels

-

Tariff developments — Guidance based on tariffs announced as of January 28, 2026; additional tariffs could impact costs

-

Raw material inflation — Fats, oils, and tallow remain elevated; management noted limited near-term relief expected

-

Hill's Pet Nutrition — While performing well ex-private label, the pet category has softened and dog dry segments have seen pressure

-

China performance — Colgate brand performing well (+mid-single digits), but Hawley & Hazel subsidiary continues to face challenges in premium e-commerce

-

Consumer uncertainty — CEO Wallace noted "it's not a question of them being confident. It's just the uncertainty with all the moving parts"

Q&A Highlights

Guidance Range Interpretation (Morgan Stanley)

When asked about the wide 1-4% organic sales guidance range, CEO Noel Wallace clarified the framework :

"It's pretty simple. If categories get worse, we're at the low end of that guidance range. If categories stay where they are, then we're in the middle of that 1%-4% range, more than likely. And if categories strengthen, we hope to obviously achieve more towards the higher end of that range."

Hill's Pet Nutrition (UBS)

Hill's delivered a strong quarter despite category headwinds :

- Underlying volume (ex-private label) up 2%

- Prescription diet business growing with improved market shares

- Gaining share across all channels

- Tonganoxie plant providing greater flexibility for wet product globally

North America Challenges (Bank of America)

Management provided granular detail on U.S. category weakness :

- 9 of Colgate's categories saw negative volume in October, 10 in November

- December improved to only 6 categories with negative volume

- Home care particularly impacted — dish and fabric softener down mid-single digits

- Government shutdown, SNAP reductions, and consumer uncertainty cited as drivers

China and Hawley & Hazel (Evercore)

The Colgate brand's success in China is being transferred to Hawley & Hazel :

- Marketing leaders sent to China for "immersions" in omni-channel demand generation strategies

- New dual-chamber technology product launched at super premium tier on Hawley & Hazel

- Structural changes made to the business for improved go-to-market execution

Latin America Momentum (J.P. Morgan)

Both Mexico and Brazil contributed high single-digit growth in Q4 :

- Will lap the Colgate Total reformulation headwind in 2026

- Pricing still achievable given brand strength and fats/oils inflation

- Middle price tier getting squeezed; super premium and value growing

M&A and Balance Sheet (Wells Fargo)

CFO Stan Sutula highlighted capital allocation flexibility :

- Record operating cash flow of $4.2B in 2025 (vs. $3.6B free cash flow)

- Strong improvement in net working capital and cash conversion cycle

- Low leverage provides "dry powder" for M&A

- Discipline remains key — "if we found the right opportunity to utilize our balance sheet, we would"

2030 Strategy Launch

Q4 2025 marks the transition from Colgate's completed 2025 Strategy to the new 2030 Strategy :

Five Key Focus Areas:

- Strong brands with global reach — Colgate is the most penetrated brand in the world, helping drive distribution in emerging markets

- Innovation acceleration — Additional resources for science-based innovation across all price tiers

- Omni-channel demand generation — Delivering personalized content and messages at the right time and place

- Scale capabilities — AI, data analytics, revenue growth management, and AI-driven innovation

- High-impact culture — Aligning KPIs with training and development programs

The organizational structure is being redesigned to "de-silo" e-commerce from brick-and-mortar, creating a unified commercial organization for the omni-channel consumer .

Bottom Line

Colgate-Palmolive delivered a solid Q4 2025 with meaningful growth acceleration, record free cash flow ($3.6B) and operating cash flow ($4.2B), and constructive 2026 guidance. While organic growth of 1-4% for 2026 remains below the company's 3-5% long-term target, it reflects a realistic assessment of the challenging category environment. The SGPP program provides a framework for continued EPS growth even if categories remain soft, while the company's strong cash generation supports both reinvestment and shareholder returns.

CEO Wallace expressed confidence in the company's positioning: "I'm confident in our ability to navigate through this uncertain environment. I believe we have the correct long-term strategy, very well-designed 2026 plans, and of course, the best people and culture" .

The +2.1% aftermarket reaction suggests investors are gaining confidence in Colgate's ability to navigate through the current soft patch and execute on its 2030 strategy priorities.

Related Links: